Understanding Banking BPO Services: Benefits, Processes, and Best Practices

So, when a Southeast Asian Regional bank embarked on its digital transformation program, it was a matter of time before leadership understood the back-office burden compliance checks. Innovation is being stifled by customer onboarding, loan reviews, and credit-card operations. It was churning out awesome customer-facing products but took 15 days to approve a new credit card, and accounts were still reconciled manually. With growing pressures and mounting regulatory complexity, the executive team looked at banking BPO services as a strategic enabler instead of a cost center.

With the growth of global financial services by Fintech companies, legacy banks, and neo-banks, banking BPO services are essential to ensure pillars such as scalability, compliance, and high return-to-cost ratio operations. Increasing regulatory pressure, the standardization of digital lending platforms, and customer expectation of instant services have contributed to this bowl-style change.

What Are Banking BPO Services?

Banking companies during their BPO services outsource their none-core yet essential banking processes to specialized providers. These services encompass various activities such as KYC and compliance outsourcing, loan processing BPO, mortgage processing service, credit card operations outsourcing, risk management BPO, back office banking operations, financial customer service, and Fintech outsourcing services.

The increased operational cost of scaling compliance, customer support, and transaction processing becomes cumbersome as banks open up new markets or decide to launch various digital models. By providing efficient processes, skilled personnel and new technology, BPO providers take care of the non-core processes and let the banks concentrate on growth and innovation.

Why Banking BPO Services Are Growing Rapidly

Why Banking BPO Services Are Growing Rapidly

Cost and Efficiency Drivers

By outsourcing strategic and high-return banking functions, institutions can turn fixed costs into variable, transactional models, by volume. According to an ISG report (2023), financial services firms that adopted Business Process Outsourcing achieved cost savings of 12–18% in processing operations. (isg-one. com)

Compliance and Risk Management

Compliance continues to be among the largest headaches for banking institutions. According to a study by Thomson Reuters, banks allocate an average of 10% of operating expenses on compliance and risk management related activities. (thomsonreuters. (Your Story: How Banks Gain Competitive Advantage from Regulatory Compliance Outsourcing and KYC and Compliance Outsourcing By Using Specialist BPO Partners is here) Banks leverage domain expertise, automated workflows, and pre‐built frameworks by outsourcing regulatory compliance and KYC and compliance to specialist BPO partners.

Digital Customer Expectations

Customers today expect speed, transparency, and any-time service. Close to 64% of banking customers indicated that they will change banks due to slow processing or delayed onboarding, as per the report by Accenture. Banking BPO services offer automated customer onboarding, efficient credit-card issuance, and channel-agnostic financial customer support across channels.

Best Practices for Deploying Banking BPO Services

- Establish clear SLAs and KPIs: turnaround time, accuracy, compliance metrics must be quantifiable.

- Make sure tech integration: providing should integrate along with your core banking device raising, CRM and records systems.

- Choose domain-expert provider: outsourcing to a generic BPO poses the risk of misalignment in process and regulatory perspective.

- Prioritize data security & regulatory frameworks: look for ISO 27001, SOC 2, audit certificates.

- Maintain joint governance structure: regular performance reviews, process improvements, and risk escalation paths.

Example: How One Bank Transformed through Banking BPO

Fraud losses were far lower in this market, and a leading European retail bank was struggling with an average customer onboarding time of 12 days for new accounts, and high costs for card issuance. Results followed after an organization transferred their loan processing BPO, credit card operations outsourcing, and back-office banking operations functions to an experienced service provider:

- Onboarding time from 12 days to 3 for customers.

- Card-issuance cost dropped by 22%.

- While in 12 months, the compliance breach incidents have reduced by 35%.

By delegating transactional and compliance-heavy processes to a BPO partner, the bank could refocus internal teams on customer acquisition and product innovation.

Discover the Power of BPO Finance

Handling complex financial operations in-house can hinder growth and scalability as businesses expand. BPO Finance provides a smarter approach to the future blending expertise, automation, and efficiency to elevate each financial process. [Read More →]

What to Consider When Selecting a Banking BPO Partner

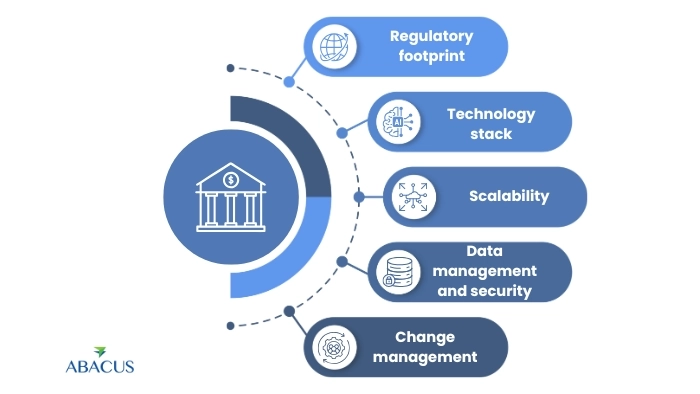

When banks assess an outsourcing partner, it is no longer just about price. The partner needs to be in sync with strategic goals, regulatory requirements, and digital transformation tracks. Key considerations include:

- Regulatory footprint: Does the provider have experience in your jurisdiction(s)?

- Technology stack: Are they able to accommodate RPA, AI, live examination for customer support and risk?

- Scalability: Will they flex with you as you grow products or geographies?

- Data management and security: Vital for financial data management services, and risk operations.

- Change management: Transitioning operations without disruption is vital.

Future Trends in Banking BPO Services

Adding to this, the trends emerging in the evolution of banking BPO are the following, as we are moving towards 2025 and beyond.

- Embedded AI and analytics: Business process outsourcing providers will move beyond transactional outsourcing to decision-support outsourcing, providing insight as well as execution.

- Functional & Tech-Centric Services: BPOs will stop being mere task processors, and will become end-to-end shared-services platforms combining operations, technology, and governance

- On-demand or “pay-as-you-grow” models: Especially useful for fintech outsourcing services and fast-scaling banks where agility matters.

Conclusion

In this time when banking is being transformed with fintech innovation, new regulation and changing customer expectations, the old way of running operations no longer fits the need. Banking BPO Services Abacus Outsourcing Banking BPO Solutions are a strategic avenue to scale your finance and accounting operations swiftly, accurately and with resilience. We enable internal teams to do what they do best, innovate and grow customers while back-office operations operate in a highly efficient and compliant manner.

Whether you struggle with speeding up customer onboarding, cutting loan processing costs, optimizing card operations or reducing compliance risk, Abacus Outsourcing brings the proven capabilities to lead change. With banks and financial institutions changing at such a perpetual pace, working with Abacus Outsourcing will also guarantee you are staying light on your feet, staying compliant and building for growth.