Why Banks Are Turning to BPO Partners for Efficiency and Growth

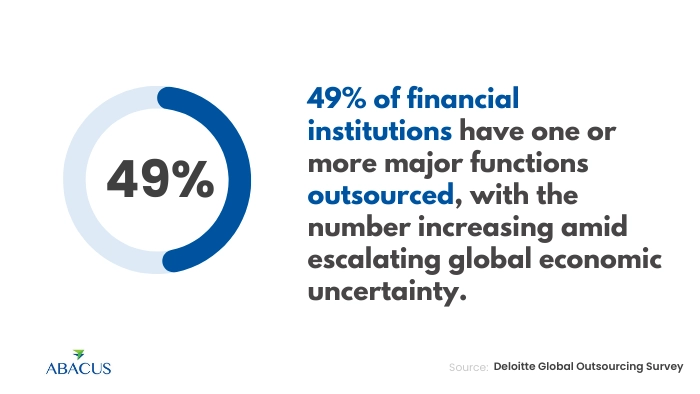

With customer expectations changing faster than legacy systems can keep up with, banks are asking a fundamental question: How do they remain competitive without having to fight the same operational bottlenecks, over and over again? For many leading institutions, the answer has become apparent: strategic partnerships with banking process outsourcing providers.

A few months back, a mid-sized retail bank in Southeast Asia was facing a backlog of loan applications, delayed KYC checks and mounting customer complaints. Following a relocation with much of its KYC and compliance outsourcing and loan processing BPO to a niche partner, the lender witnessed turnaround times reduced by 40% and customer satisfaction reached unprecedented levels. That transformation has now become an exception and is becoming a global rule.

The Banking Industry’s Turning Point

As our new research reveals, increasing operational costs, more stringent regulatory requirements, and shoppers who expect instant service all points to crossroads for banks today. Internal structures-built decades ago can no longer deliver the agility required to compete against Fintech disruptors.

It is for this reason that institutions are adopting Backoffice banking operations outsourcing, mortgage processing services, and other banking customer support functions powered by best-in-market teams. Banks believe that with this shift, internal resources can be directed towards strategy, customer experience, and innovation instead of administrative overhead.

Regulatory Pressures Are Driving Operational Reinvention

Another industry that is examined as closely as the financial sector is difficult to find. Regulations are always changing, and banks must comply and do so correctly and immediately. This necessitates large teams, expensive training programs, expensive technology, and most institutions lack the resources to afford them all internally.

This is the point where KYC and compliance outsourcing and regulatory compliance outsourcing become really helpful and even needed. Here are what outsourcing partners focused on financial regulations deliver:

- Global Standards trained dedicated compliance experts

- Real-time monitoring technologies

- Automated fraud, AML [anti-money laundering], and high-risk transaction checks]

A study by PwC found that compliance costs now account for 15–20% of total banking operational spending, making BPO partnerships a cost-effective alternative.

Source: PwC Financial Services Risk & Regulation Report

Speed, Accuracy, and Scalability in Loan & Mortgage Processing

Banking has some of the most document-intensive as well as urgent activities — loan and mortgage processing. Customer experience and deals are often lost over even the slightest delay.

Normally, loan processing BPO, as well as mortgage processing services, enables banks to have expedient access to professionals who are trained to professionally cater to them and automated workflows that boost efficiency. Outsourced teams manage:

- Application indexing

- Credit checks

- Document verification

- Underwriting support

This results in quicker decision-making and lower operational overhead. According to a report by McKinsey, through automation and outsourcing, the loan processing time can be reduced by as much as 60% and also accuracy of data can be improved.

Source: McKinsey Global Banking Review

Optimizing Credit Card Operations Through Outsourcing

Issuing requires several duties, including credit card application processing, fraud monitoring, internal dispute resolution, customer service, and account maintenance. All ask for precision and round-the-clock alertness.

For banks that want to simplify these processes, an increasing amount of operations are outsourced to third-party credit card processors. Outsourced teams and automated systems to mitigate fraud, speed up customer verification processes, and assist your customers in real time through multiple channels. This has been crucial to upholding trust in digital payments, especially with the maturation of real-time transaction monitoring.

Enhancing Customer Experience with Specialized Support

The expectations of customers in banking experience have completely changed. From phone chats to mobile apps, we now have the expectation that responses are up to the minute, service is personalized, and interaction is seamless across various channels.

With an effective outsourcing partner, financial customer support allows banks to provide this experience all the time. Banking oriented service teams for inquiries & disputes, digital onboarding, and account queries while ensuring compliance and security

Fintech and Digital Transformation Are Fueling Outsourcing Demand

Fintech had a boom, and banks needed to speed up the digitization process. However, building digital capabilities in a house is costly and requires time. This is why numerous institutions depend on fintech outsourcing services as they provide you access to:

- API integration support

- Digital onboarding solutions

- Automated KYC systems

- AI-enabled risk monitoring

- Cloud-based compliance tools

It gives traditional banks the ability to act quickly and flexibly like a fintech without a massive investment.

Risk Management Becomes Stronger with BPO Partnerships

Risk management has a much deeper dimension in contemporary banking than a mere analysis through financial lense. This includes things like fraud detection, cybersecurity, transaction monitoring, and regulatory tracking. Risk management BPO outsourcing firms enable banks to identify and reduce threats by using:

- AI-based fraud detection tools

- Real-time analytics

- High-volume transaction monitoring

- Updated global regulatory frameworks

Preventing costly regulatory violations and reputational risks in this fashion.

In-House Operations vs. Banking BPO

Function | In-House Banking Teams | Specialized BPO Partner |

KYC & Compliance | High cost, frequent training required | Faster checks, expert compliance teams |

Loan Processing | Slow during peak periods | Scalable teams reduce turnaround time |

Credit Card Support | Requires 24/7 staffing | Always-on global support |

Risk Management | Limited internal tools | AI-enhanced fraud detection |

Customer Support | Higher overhead | Multichannel, trained banking specialists |

Conclusion

The banks that are embracing outsourcing are all looking ahead and leaving behind the rest: these banks aren’t skimming, but positioning for a world in which efficiency, compliance and customer experience are the keys to market leadership. Outsourcing the banking process to experts enables institutions to focus on what truly matters for growth: innovation, trust, and strategic expansion.

As the customers want fast and the regulators want accuracy, the BPO partner provides the edge. This kind of partnership is surely the shape of the future within which that our banks are working supported collaboration, agility, and needs-based support via outsourcing also are not prone to change once when more banks realize and witness the impact of outsourcing.