Any business seeking growth has the fundamental goal of gaining new customers. However, this is in turn inevitably a costly effort, being summed up with Customer Acquisition Cost (CAC). CAC includes any expenditure you make while converting a potential customer to a paying customer such as a marketing campaign, a sales effort or any investment relevant to it.

Understanding CAC is not an accounting issue; it’s fundamental to a company’s pricing strategies, and the profits it makes, market share it takes and how the company will succeed over the long term.

What is Customer Acquisition Cost (CAC)?

Customer Acquisition Cost (CAC) is defined as the average cost to attract, acquire and solidify the relationship to the first sale with a new customer.

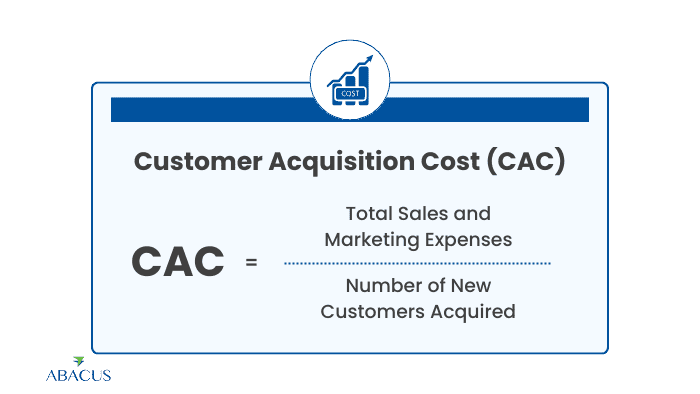

Customer Acquisition Cost is a metric that tells us the total cost a company spends to acquire a new customer. They include all such expenses that a business incurs on marketing, advertising, sales and others for attaining leads and converting them into paying customers. The formula for calculating CAC is straightforward:

CAC= Total Sales and Marketing Expenses / Number of New Customers Acquired

For example, if a company spends $100,000 on marketing and sales efforts in a month and acquires 500 new customers, the CAC is:

CAC= 100,000 / 500 =200

In other words, it costs the company $200 per customer.

How CAC Influences Pricing Strategies?

Your pricing strategy should be devised in a fashion that not only pays for the cost of acquiring your customers, but also helps with your long term profitability. CAC directly influences the price decision as well, because if a business is spending heaps to get a customer, it needs to make sure that customers generate the revenue to rationalize the expenditure.

Say your CAC is high, so you’re going to have to increase the price point of your product or service. It allows the BPO company to make up the acquisition cost quickly and start making profits. On the contrary, if your CAC is low, you’ll find you might have some wiggle room to play with your price competitiveness or give discounts without putting your company’s financial health at risk.

In many ‘been there, done that’ industries, knowing what your CAC is can tell you how to price a product — as a premium offering or as a low price, value option? That also helps you decide whether you need to adjust your prices depending on the cost of customer acquisition or CAC or perhaps explore different ways of lowering the CAC.

The Relationship Between CAC and Customer Lifetime Value (CLV)

While developing pricing strategy, you should be looking at how Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLV) relate to one another. CLV is the total revenue a customer will create while they’re a customer at your company. Given CLV is a key predictor of sustainable pricing strategy and there is a relationship between CAC and CLV, this relationship between CAC and CLV is a primary driver of sustainable pricing strategy.

A common rule of thumb is that a company should aim for a CLV to CAC ratio of 3:1. In other words, you should make three times the cost of acquiring a customer in revenue from them during their lifetime. Because the ratio is maintained, the business is possibly in a good financial situation.

For example, if a customer has a CLV of $600 and your CAC is $200, the CLV to CAC ratio is 3: If your pricing strategy is a success, you should be coming in at or close to $1. Alternatively, if your CAC is high compared to your CLV, you may have pricing too high, or customer acquisition is too expensive to deliver on the overall equation.

Adjusting Pricing Based on CAC

Practically, one of the best ways to leverage CAC to inform your pricing strategy is by changing your price based on the cost of customer acquisition. If you see your CAC increase (because of higher advertising cost, higher competition, other factors) then you might want to think about a price increase to keep the margin.

For example, the increase in paid marketing expenses and CAC could indicate that a SaaS company may choose to alter the pricing structure of its subscription to cater for the higher cost. But you have to do this with care, lest you lose your customers. Finally, businesses need to be sure that value is being provided to the customer, or the value is justifying any price they’re asking the customer to pay.

Likewise, an unexpectedly low CAC gives you the chance to be aggressive with discounts, lower prices, bundle services, etc. Doing this could get you more customers who still can pay you. But if you cut prices way too much, you can actually damage your revenue in the long term if the price cut can’t be reconciled with the customer’s value over their lifetime.

How to Lower CAC for Better Pricing Flexibility

Lowering your CAC means you’re less constricted in pricing yourself competitively, your margin is going to improve, and even with the reduced margin, you may have the opportunity to invest more heavily in customer retention. There are several strategies to reduce CAC, including:

- Improved Targeting and Segmentation: By narrowing in on your high value segments, you’ll spend less wasted dollars and make sure you’re hitting the right audience. This helps in reducing CAC and bringing higher conversion rates when properly segmented and used in the right personalized marketing campaigns.

- Referral Programs and Word-of-Mouth Marketing: Referring is a great way to lower CAC since you’re already preselling to existing customers. Traditional advertising is more expensive than word of mouth marketing and referral programs, but the quality of the leads you receive are higher.

- Automation and Technology: By taking advantage of marketing automation tools as well as CRM and data analytics tools, marketing campaign and sales funnel can be optimized without manual intervention which subsequently lowers CAC over time.

- Content Marketing and Organic Traffic: It’s possible to reduce CAC in the long term by building organic traffic through SEO and content marketing. While content creation may take more time and more money up front, it also continuously brings in leads without having to keep buying ads to do so.

Balancing CAC with Other Business Costs

Although it is important to adjust pricing based on CAC, we can’t completely overlook other business costs (such as production, fulfillment, overheads). These factors should not be isolated from pricing decisions. As a result, if a BPO outsourcing company raises its prices to cover high CAC without paying attention to other costs, then, it might lead to an imbalance, which would be deleterious to the profit margin of a company.

To do this, businesses need to think holistically about their cost structure and make sure their pricing is based on what it will cost to acquire a customer and the cost of running your business overall. A comprehensive approach will help them maintain their profitability and competitiveness in the market.

Wrapping Up

Businesses often face challenges in managing costs, optimizing processes, and maintaining consistent growth. Abacus Outsourcing simplifies these complexities by offering customized outsourcing solutions that help clients improve efficiency and reduce operational burdens.

From refining customer acquisition strategies to fine-tuning pricing models, we provide valuable insights and support that enable our clients to achieve their goals. With a focus on cost-effective and reliable solutions, we help businesses enhance productivity while allowing them to concentrate on their core operations.